Worry less.

Live more.

We give you the confidence, guidance, and peace of mind you need to design a life you don’t want to retire from.

Worry less.

Live more.

We give you the confidence, guidance, and peace of mind you need to design a life you don’t want to retire from.

Find your financial sanctuary

- Control over your financial life

- Confidence that you’re making the right financial decisions

- Peace of mind, knowing you are going to be okay

- Clarity about what comes next, without the stress

- A trusted advisor who provides unbiased guidance

- A plan in place to fuel your dreams

We help you get there with transparency, simplicity, and true partnership.

One service. One fee. Everything you need.

Integrated Financial Planning

From retirement strategy and tax planning to Social Security, healthcare and legacy – your entire financial life mapped out and maintained. We guide you through both the numbers and the questions that come with life’s biggest transitions.

Professional Investment Management

Your portfolio designed, managed, and monitored by experienced advisors who understand how your investments serve your life – not the other way around.

One Flat Quarterly Fee

No percentage-based charges. No hidden costs. Just one transparent fee that covers everything so you always know what you’re paying and why.

Nice to meet you!

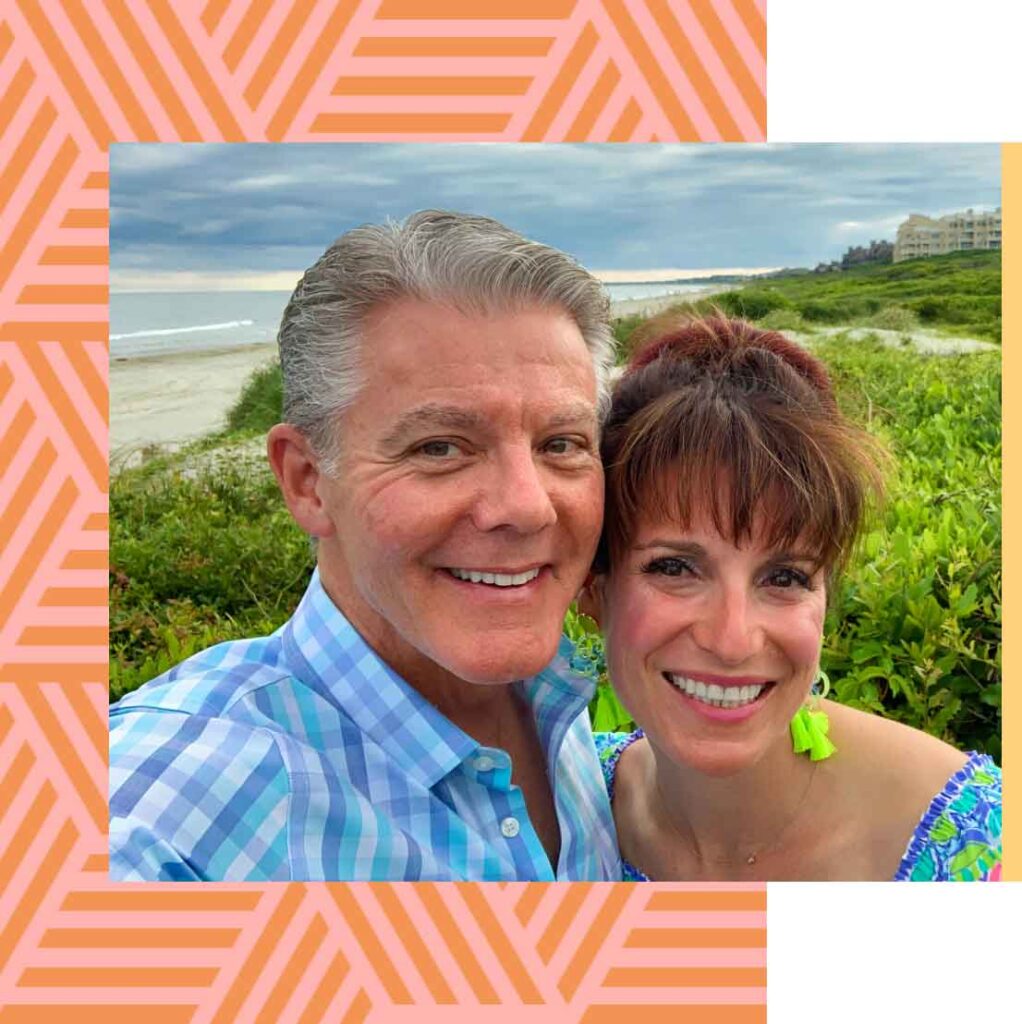

We’re Sarah and Jim – two advisors shaking up the wealth management industry with our client-focused approach to delivering financial advice, and our fair and transparent flat-fee pricing.

What do our clients think about working with us?

These clients have not been paid or received any compensation for providing testimonials, and there are no material conflicts of interest.

Just some of the situations we help with

The Foundation Builders

Maya & Peter

Maya and Peter are financially stable, but growing wealth brings complex choices around housing, college savings, estate planning, and investments.

The Strategic Structurers

Chris & Monica

Chris and Monica are doing well and saving steadily, but with kids in school and college, they’re now weighing tuition, retirement moves, and long-term flexibility.

The Transition Testers

Mark & Jenna

Mark and Jenna are eyeing major life changes, including career shifts, travel, and honoring a philanthropic pledge—all while considering a drop in income.

Living the Plan

Noah & Avery

Noah and Avery are excited to retire but overwhelmed by pension choices, rollovers, Social Security, Medicare, and replacing their paychecks.

Refining Life and Legacy

Eleanor

Eleanor is financially secure but seeking simplicity through downsizing, giving during her lifetime, and ensuring her plans reflect her values and are clear to her family.

Insights

Meet Sanctuary Financial Planning

Meet Sanctuary Financial Planning, a flat-fee financial planning firm that we founded to change how financial advice is delivered to clients.

Common Financial Headaches

Everyone has financial headaches. Do any of these feel familiar to you? If you said yes, you are exactly why we founded Sanctuary Financial Planning.

Seeking Certainty in an Uncertain World

We turn to all kinds of tools and patterns to tell us what to expect because we want certainty about the future. We CRAVE certainty about the future.

5 Steps to Hiring a Financial Advisor You Trust and Like

Your financial future is too important to trust to just anyone. We’ll walk through 5 steps you can take to find a financial advisor you trust to help you build financial security today and for years to come.

Are you ready to take control of your financial life?

Schedule your free introductory call to see if Comprehensive Wealth Management is right for you.

- Share your situation and what you’re hoping to accomplish

- Learn how we work and what’s included

- Decide if we're the right fit and determine the best path forward